Stock Alchemist 股之鍊金術師

If heaven doesn't favor us, If body and mind are worn out, Carry your goals and go even further~~ 若天不眷戀 若身心耗損 帶著目標走更遠~~

2025年1月25日星期六

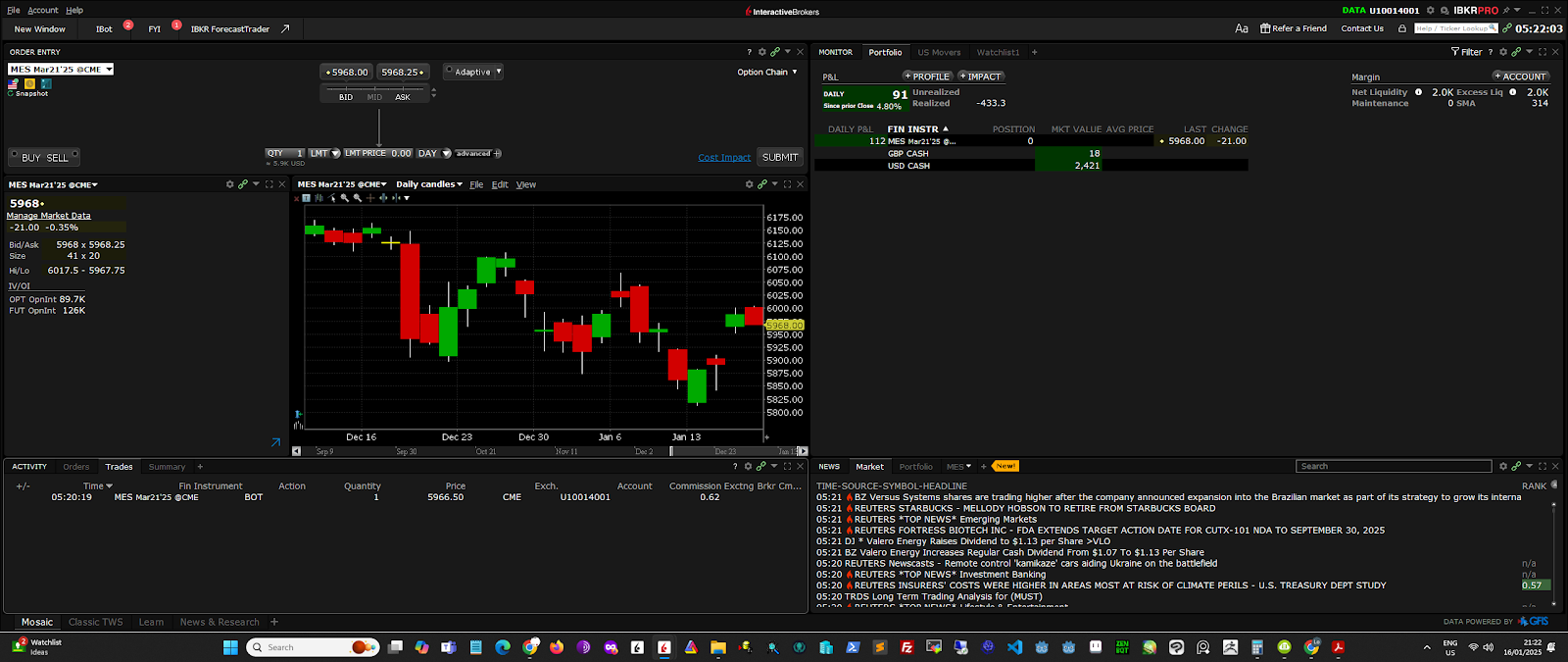

A BIG LOSS!!! Overlooked potential resistance!

2025年1月12日星期日

Happy New Year!! First entry in 2025!

1. Possible Head and Shoulder Top.

2. Profit target >200 points is huge range and may not be possible to meet.

3. There is a nearest downside resistance around 5800 which is extended from the double dips at the starts of 3rd Oct & 4th Nov.

4. The breakout bar with higher volume than the usual.

2024年12月22日星期日

Find a better entry price!

One thing, too late to enter the trade, the entry target is 6127.25, but it slips to 6118.75 as entry price after next opening session at the same day @ 1100 pm. While EZ pulls back over 6148 next day, so that means a better entry price existed in the next day everytime after trade entrys. The executed target price hurts the profit at the end.

2024年10月31日星期四

It's a ridiculously huge MISTAKE!!!! (Overlapping trades)

After a small loss and small profit, I faced a new chance for a downside trade. It worked into my favour and went quite well with my theory, but I've made a big mistake!!! I put in the SAME profit taking price as my buy-in market price!! This is absolutely unforgiving and what a casual mistake!!! Damn it!